SilverGoldPill.com

Your trusted source for gold and silver coins.

2021 Silver Price Predictions

May 9th, 2020

The below references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

What can we expect for silver, one of our favorite precious metals for the remainder of 2020 and moving forward into 2021? For starters, of the three commodities I tend to cover-- gold, silver and bitcoin; silver has been the biggest laggard; and rightfully so.

With digital assets making another run and the wealthy heading to gold as a safe haven during Covid-19, silver is left in the dust. But don't count it out. Let's take a closer look at silver.

Demand For Silver Will Rise Due to a Reduction in Silver Mining

Silver is a by-product of copper mining, and copper is directly connected to the economy since copper is used in wiring for homes and buildings (roofing and plumbing), and industrial machinery. Therefore, if copper mining is down due to the economic downturn, the by-product of copper mining --silver will also be low in production.

This will help increase the price of silver well into 2021 and beyond, since silver is a necessity for many technology and industial applications.

Precious Metal Demand in India

Gold has always been India's go to precious metal, but as the value of gold continues to increase, many are turning to silver. An article from the India Times found here explains:

India consumed 160.6 million ounces (4,996 tonnes) in 2016, which accounted for a noteworthy 16 per cent of global silver demand. Silver imports reached nearly 225 million ounces in 2018, which was over 35 per cent higher compared to 2017.

This steady increase in silver demand in countries like India coupled with silver being mined less is a great indicator for silver prices to rally in the near future.

Basic Supply & Demand

Globally, silver demand in 2019 was up 0.4% due mainly to vehicle electrification and photovoltaic demand.

An increase of less than 1% does not seem substantial; yet when coupled with silver supply decreasing 3.8% in 2019; if this trend continues silver will begin to rebound from the current selloff and see certainly see increases in the upcoming years.

For a full at the numbers posted above click here to read the article provided by ResourceWorld.com.

The Gold to Silver Ratio

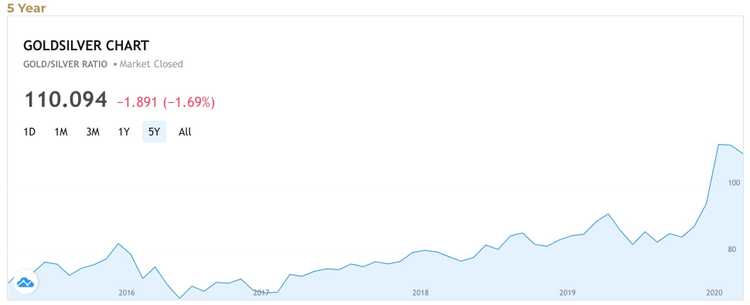

Above is an image of the gold to silver ratio captured at the time of this article being written.

Above is an image of the gold to silver ratio captured at the time of this article being written.

As silver enthusiasts we are constantly reminded of the gold to silver which essentially is how many ounces of silver you can get with one ounce of gold. At the time of this articles publication, the ratio is 110:1 (check here for an up to the minute site).

Historically the ratio is much lower, and many believe a more suitable ratio is somewhere around 60:1. This means one of several things; either silver will increase in value substantially and gold will remain fairly flat, or gold will decrease substantially, and silver will remain flat. Many experts agree that the ratio needs to correct.

Historically, silver always trails gold. If gold find itself in a bull run, we can usually expect silver to follow suit. Therefore, a prediction of silver rallying in the upcoming year is a reasonable assumption.

Summary

With global silver supply continuing in a downward trend, paired with an increase in demand and following in golds footsteps we can expect to see silver touch $20 USD in mid 2021 and continue to float in the high teens and low twenties for the rest of the year.

This would represent a 25% increase over the span of 18 months; which is quite resonable.

If you are a long term physical investor, or whether you want to make a paper play with the SLV ETF, silver is a wise decision. With the price of gold getting too expensive for some people's blood, we can expect silver to become the obvious alternative.