SilverGoldPill.com

Your trusted source for gold and silver coins.

Silver Investing Tips for Beginners in 2020

April 9th, 2020

The below references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

With the current price of spot trading at under $16 USD per ounce now is a great time as an investor to consider putting some of your money into physical silver. Let's look at some general tips when getting started and how to make the most of it.

1. Stay Away from Collector Coins and Numismatic Coins

The more packaging a coin comes with or the lower the mintage is the more likely you are paying for packaging and hype. These types of collector’s coins might initially sell well but they do not hold their value well over time. Unless you are looking at buying a collectors / premium coin and "flipping" it on eBay for a quick profit you should avoid these coins at all costs.

The same goes for numismatic coins. While they can be profitable in the long run, it takes an incredible amount of knowledge and foresight to make sure you are getting something that is fair priced and will be a good investment. I recommend staying away from numismatic coins.

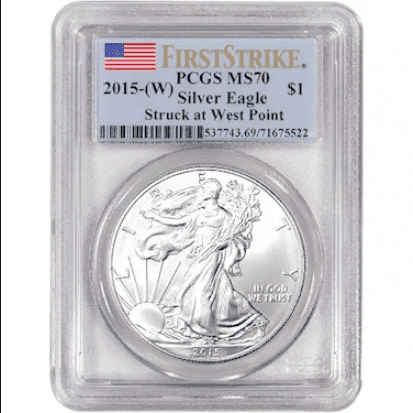

2. Do Not Buy Slabbed / Graded Bullion Coins

An American Silver Eagle is just that; they are bullion; no local coin shop or individual will be paying you more for your ASE because it graded and slabbed. Do not be a sucker. Down the road if you have a tube of 20 sealed ASE's, you can have them graded yourself. Never buy graded bullion.

3. Avoid Fractional Silver

Do not buy any silver less than an ounce. You are paying a hefty premium. Quarter ounce and half ounce coins are certainly cool and would make a nice gift but they are most definitely a bad investment.

4. Always Buy from Reputable Online Sites Until You Are Comfortable Making Private Purchases

Some of my most profitable silver and gold purchases were done privately through Kijiji and Reddit. However, as an inexperienced stacker stick to Kitco, Apmex, SD Bullion and SilverGoldBull and compare prices. If there are "culled" coins, which means previously owned; they make a great first purchase. The reason I say this is because it allows you to get close and touch your silver and enjoy it. If your first purchase of silver are coins that are in protective plastic cases or brilliant uncirculated, they require extra attention. Silver is cold, it has a unique smell, it makes a beautiful ringing sound when pinged. This will help you get a better "feel" for determining real and fake silver down the road when you make private purchases.

5. Stack What Your Market Allows

You're Canadian? Stack Silver Maple Leaf’s. You're American? Stack American Silver Eagles. If your country does not mint their own bullion coins, find out which coin in your country comes with the lowest premium over spot price and find out what coin your local coin shops are willing to buy at a fair price.

6. Don't Make Your First Purchase Huge

You have your whole life to stack precious metals. Don't make a huge impulse buy only to regret it a few months later. A lot of sites offer new member, one-time deals. Make sure to pick those up if available. SiverGoldBull.com offers a 10 oz. bar at spot price. For a first time purchase it is a great way to get a decent amount of silver in a bar form and get your first purchase as close to possible to allow for free shipping.

7. Coin Capsules Are Not Worth it

So, you purchased a tube of beautiful 2020 Canadian Silver Maple Leaf’s. Why would you waste $20 bucks putting regular bullion into coin capsules? It is completely unnecessary, and you won't get your money back. Keep your silver in the tubes they came in or buy plastic sleeves for your silver. Don't let supplies eat up your costs.

8. Develop A Relationship with Your Local Coin Shops

Introduce yourself to your local coin shop and let them know you are interested in making a purchase. Let them know you likely won't be making a purchase right away but are interested in their opinion. Research the advice they give you and determine if they are a trusting person. Having someone who can order large amounts of precious metals at a good price or connect you with buyers to offload your silver in the future is important in this in business. Local coin shops are usually run by some of the most insightful people when it comes to precious metals.

9. Never Purchase Silver on Credit and Never Buy What You Can't Afford

Silver is a reward for your hard work. Your bills and mortgage are paid off, your 401k or RRSP is maxed out for the year, you’ve put money into some stocks and etf's, your wife is happy; okay now it's time to buy some silver. Most people out there are collecting Funko Pops or video games. Not you. You've got a physical asset that can save you and your family down the road if your countries economy takes a hit, or if you've found yourself without work. The benefit of silver is that selling it really requires a lot of deliberation and planning. You can't panic sell your silver like your equities.